Hello , Wow, what a rollercoaster week the economy has had! The pound has plunged, interest rates are up and we've had a quite startling mini budget that has boldly gone where

no Chancellor has gone before, slashing taxes. They've done this in order to encourage us to go out and spend to kick-start the economy. Actually, going for growth like this is something that I have been advocating for a while. It's not popular with the media but I consider that as we are in a time of 'stagflation' (inflation + a stagnant economy) it's most important to kick-start the economy and stop it grinding to a halt. Also,

historically cutting taxes has tended to increase the tax-take. Weird but true! |

| |

There's more volatility to come, as we know. But one thing I have noticed is that things are never as 'dire' as the media make them out to be. For a start, did you know that gas prices have plummeted in recent days all across Europe? You can read about it here. That together with the price cap the Government recently imposed and the extra £400 we're all getting to help pay our bills should calm a lot of fears. Imagine what other fearful prognoses we've been terrorised with that will not be coming true? I'm not saying that things are sunny and rosy. I see a lot of volatility and

a few crashes coming, and I think it will take us a few years to get ourselves out of the mess we put ourselves into with lockdowns, money-printing and the fall-out from the 2008 financial crash that was never properly dealt with. Some big changes need to happen, as I've been saying on TV and radio over the last few days, but none of them need to crush us. We just have to keep our nerve, keep moving forward and take everything we read and hear in the media with a large pinch of

salt! And, by the way, if you're wondering where on earth to put your money in these extraordinary times, come along to my FREE webinar on Monday to hear from the experts what you should do. I have four investing geniuses (really) who are kind enough to come along and tell us what they think and answer your questions for free so sign up now while you

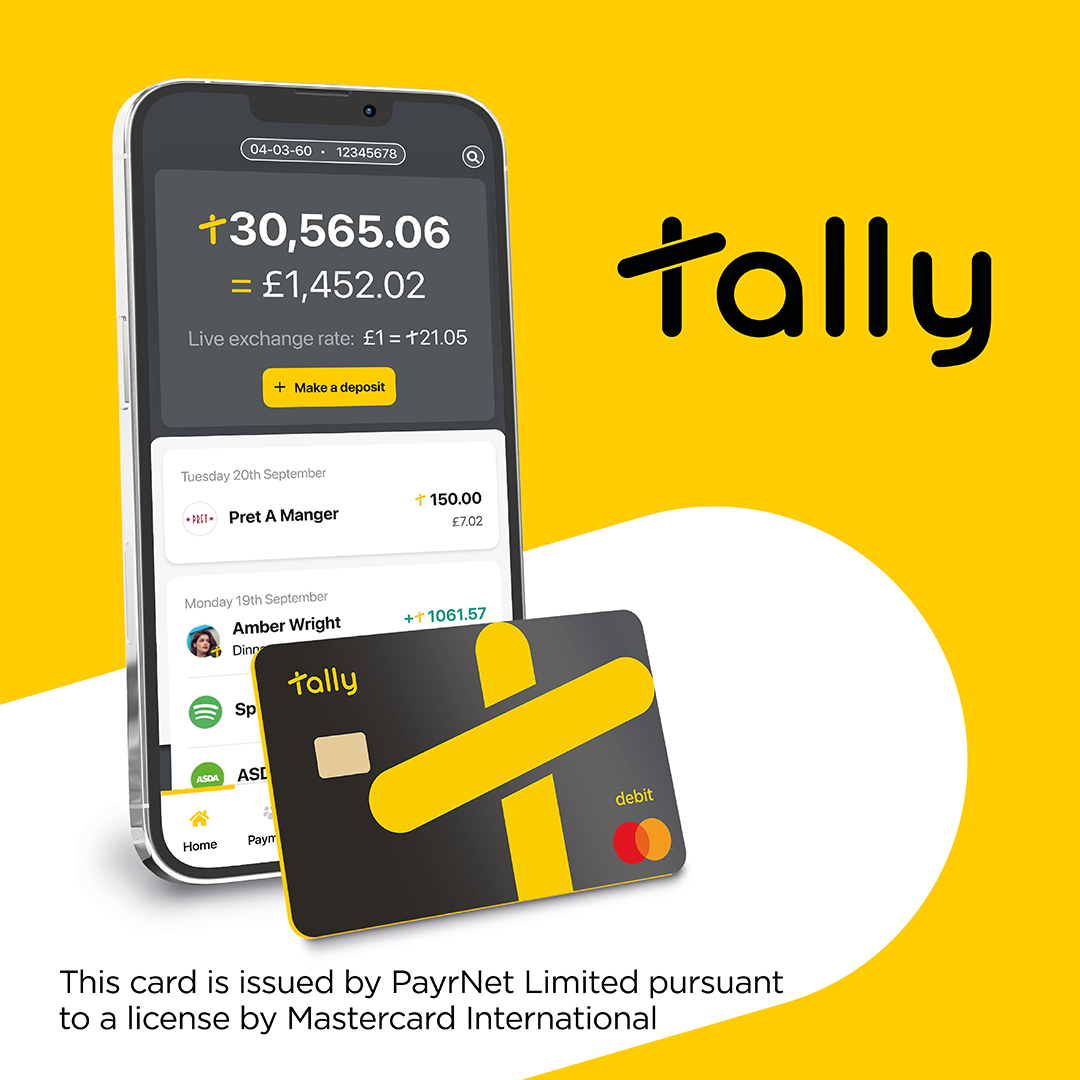

can! Of course, that includes gold (already up significantly thanks to the currency volatility) and a really easy way to do that is through Tally, a gold-backed savings account that we're big fans of. It really is one of the easiest ways to invest in gold. Try it here. This week we're also showing you how to target £1,000 of passive income a month, how to make £175 just by switching your bank account and we're looking at whether loyalty cards are still worth the bother. Oh and I'm answering your questions on video: today there are two of them so take a look at the end of the newsletter to find those. See you next week. Keep calm and carry on! Jasmine xx |

Message from our sponsors |

|

Sprive, Mortgage-Free Faster!

|

Sprive is the free app, helping thousands of people become mortgage-free faster. Using smart AI, the app automatically sets aside spare cash for you, and in one tap you can make overpayments straight to your lender. Sprive users are on track to save £10,000 in interest and shed four

years off their mortgage. The app automatically challenges your mortgage every day against 20,000+ deals and 90+ lenders to help you secure the best deal, hassle free. Join Sprive today, with code MAGPIE today and earn a £10 sign-up bonus. |

|

Sign up now

|

|

|

Scan the QR code to be taken to Sprive |

|

For irresistible deals on travel and lifestyle experiences trust Travelzoo

|

Thinking of booking a trip away?

Then make sure you're signed up to Travelzoo. From winter sun in Greece, to Christmas markets in Krakow, cosy Lake District breaks to castle stays in Cornwall, Travelzoo is the place to go for great value deals this autumn. |

|

Sign up for free

|

|

|

|

Savings worth their weight in gold

|

Inflation doesn’t just affect the weekly grocery shop. It also silently eats away at your savings. You won’t see your bank balance going down; you’ll just be able to buy less in future as prices continue to rise. Unless you save in tally, a new asset-backed currency and account designed to help you fight inflation. When you make a deposit into your Tally

Account, those funds immediately buy you LBMA-approved gold, securely vaulted in Switzerland on your behalf. Your gold is denominated in ‘tally’ in your online account, which you can save, send or spend using the app and Tally Debit Mastercard. Because tally represents physical gold, its value is determined by the price of gold. And, although the value of gold fluctuates up and down, historically it's proven to increase

in value in the long term. This makes tally the only mainstream currency that protects the long-term value of your money. |

|

Sign up now

|

|

|

|

Make an instant £29 without even leaving the house

|

If your bookshelf is looking a bit cluttered, then why not sell those books for some instant cash? WeBuyBooks are a specialist book buyer who make the process of selling books super-easy. On average, their users have made £29 each this year.

You don't even need to leave your house, they offer a free home collection

service.

|

|

Sell your books

|

|

|

|

|

Make £175 Just by Switching Bank Account

|

Switching bank accounts, if that’s something you’ve been thinking about doing, is relatively easy, and you may be interested to know that there are currently six banks who will offer you £175 cash for switching to their services. Also, it’s worth noting that some accounts pay savings interest or will offer you cashback on bills. |

|

Read More

|

|

|

|

Are Loyalty Cards Still Worth Your Time?

|

There was a time that your loyalty cards were one of the best ways to save money on the high street. Things like Boots Advantage, Tesco Clubcard and Nectar cards were in every wallet. However, like many things the way people use them has changed. So we take an in depth look at all of the best loyalty cards and decide which ones will actually make a difference to your budget. |

|

Read More

|

|

|

|

How to Target £1000 Passive Income Per Month

|

Whether you’re seeking financial independence, early retirement, or simply looking to boost your regular earnings, a passive income stream can turbocharge your chances of achieving these goals. In this article, we’re going to explain what passive income is, and give you some ideas. Keep on reading for all the

details or click on a link to head straight to a section… |

|

Read More

|

|

|

|

What the Mini Budget Means For You

|

Chancellor Kwasi Kwarteng has announced a mini-budget in parliament this morning, outlining the latest fiscal and monetary policies and steps the government are taking to protect the people of the United Kingdom. |

|

Read More

|

|

|

|

Which Supermarket Has Been Named The Cheapest Online Shop in the UK?

|

What is the cheapest online supermarket? As food prices continue to soar and many people make changes to the way they both shop for food and eat it, an online price tracker has shown one particular shop to be the least expensive option for shoppers across Britain. |

|

Read More

|

|

|

|

Pound At Lowest in 37 Years

|

Friday’s mini budget from Chancellor Kwasi Kwarteng has sent UK borrowing costs soaring, sending shockwaves through financial markets and worry through investors. This has caused the pound to slump to its lowest against the US dollar in 37 years. |

|

Read More

|

|

|

|

|

Does the Council Have a Duty of Care? Is There Financial Help For Me?

|

Welcome to Ask Jasmine, the column where I round up some of the questions I have received from readers each week. This week, I answer questions about the council’s duty of care, Queen memorabilia and more! |

|

Read More

|

|

|

|

|

Can We Just Not Pay Our Energy Bill?

|

Jack Monro in one corner, the Don’t Pay campaign in the other… You may have heard various leftfield approaches to rising bills in the UK, from advisors on TV to radicals online advising you what to do (or not do) in the face of huge energy bills. Can you simply refuse to pay? Or

can you take a less radical approach? Jasmine offers her own advise on this situation. |

|

Read More

|

|

|

|

Make Money Taking Part in Clinical Trials

|

Taking part in paid clinical trials can be a way to make a lot of money in a short amount of time, but there are serious potential downsides so be very clear about those if you go in for this. Depending on what kind of trial you take part in, how invasive the trials are, and how long they take, you can earn anything from £100 to about £5,000. If you’re

impressed by the £5,000 figure, though, ask yourself, how much could this ‘treatment’ be harming my body for them to pay me so much money? Here’s our guide to taking part in paid clinical trials for money the safe way. |

|

Read More

|

|

|

Tuesday 20th September - Platinum magazine - money column Thursday 22nd September - BBC News Channel TV - interest rates Thursday 22nd

September - BBC 5Live - interest rates Friday 23rd September - BBC Radio Scotland - interest rates Saturday 24th September - Daily Mail - Miss Moneysaver column Monday 26th September

- Jeremy Vine Extra - debt and mortgages Monday 26th September - BBC Radio Kent - the pound Monday 26th September - BBC Radio Wales - the pound Monday 26th September

- Channel 5 News - the pound 26/09 BBC

Radio 1 Newsbeat - What the pound falling means for young people |

|

|

If you think your friends or family will find this newsletter helpful, you can email it to them.

Every newsletter is bursting with money making and money saving ideas, plus exclusive deals, competition prizes and freebies.

Love, Jasmine |

|

|