Jasmine's top saving tip PLUS easy ways to make quick cash

Published: Tue, 11/29/11

| |||||||||||||||||||

|

Problems viewing this email? Click here to view it in your browser Hi , | |||||||||||||||||||

THE NUMBER ONE THING YOU MUST DO THIS WEEK Revealed! Jasmine's top family savings tip

Jasmine says: "Young people are  facing a tough economic time in the next few years. Of course you want to help your little ones get through it and have a secure future with some money in the bank for things they will need later on like university fees, a car or a deposit on a house. facing a tough economic time in the next few years. Of course you want to help your little ones get through it and have a secure future with some money in the bank for things they will need later on like university fees, a car or a deposit on a house. This is why I'm particularly interested in the Junior ISA from Family Investments. It's a stocks and shares ISA, which I like because long-term they do better than cash ISAs. Also, they are mostly invested in index-tracking funds which I am a big fan of. There are two types of investments you can choose from: a standard fund and an ethical fund.  The ethical fund is great because it is totally invested in an index-tracker called FTSE4good which is only made up of ethical companies. The ethical fund is great because it is totally invested in an index-tracker called FTSE4good which is only made up of ethical companies. The standard one is also mostly invested in index-tracking funds with some property and bonds added in. The fees for both are just 1.5%. Family Investments are a longstanding and trustworthy company with 35 years experience and they have won the Moneyfacts award for best Child Trust Fund Provider twice, in 2011 and in 2010. As with all Junior ISAs you can invest up to £3,600 a year completely tax-free, but what's fabulous about this particular one is that you can invest from as little as £10 a month and other family members like grandparents can add their own contributions too. It's a great way for the whole family to put something away for your children's future. If you all get together and help to contribute £300 a month for your child, by the time your son or daughter is 18 they should be able to afford university, and maybe have money left over for a deposit on a house. So what are you waiting for? Start saving for your child today." | |||||||||||||||||||

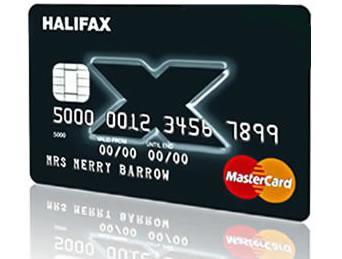

AVOID PAYING INTEREST ON YOUR CREDIT CARD THIS XMAS Are you planning to pay with plastic when it comes to covering the cost of Christmas? Then look no further than Halifax's All In One Credit Card. The card offers a market-leading 0% interest

on balance transfers and purchases for 15 months. Are you planning to pay with plastic when it comes to covering the cost of Christmas? Then look no further than Halifax's All In One Credit Card. The card offers a market-leading 0% interest

on balance transfers and purchases for 15 months. So you get the best of both worlds - you can spread the cost of your Christmas purchases and avoid paying interest on those inevitable January credit card bills. In fact, it gives you the freedom to plan your finances for the full year ahead and beyond. Applying for this offer - not available in high street branches - takes just five minutes and you should get a decision instantly. You can then manage your card online and take control of your finances. Go to the Halifax website now to learn more about this great offer (and to apply, of course!) | |||||||||||||||||||

|

MOST READBARGAIN BOX

BLOG BOX

| ||||||||||||||||||

This is your free email newsletter from Moneymagpie.com, the site that helps you take control of your finances and build a richer life. Nothing in this email should be taken as financial advice - please do your own research based on your own specific circumstances. Any action taken is at your own risk. We won't try to sell you anything, or give your details away to other people. Promise. | |||||||||||||||||||